The Ecobank Pan-African Card

The Ecobank Pan-African Card is issued by Ecobank Nigeria, one of the leading financial institutions in Nigeria. It’s the first Pan African financial institution with offices across Africa. This bank provides financial services, including personal loans, home loans, mortgages, and emergency loans.

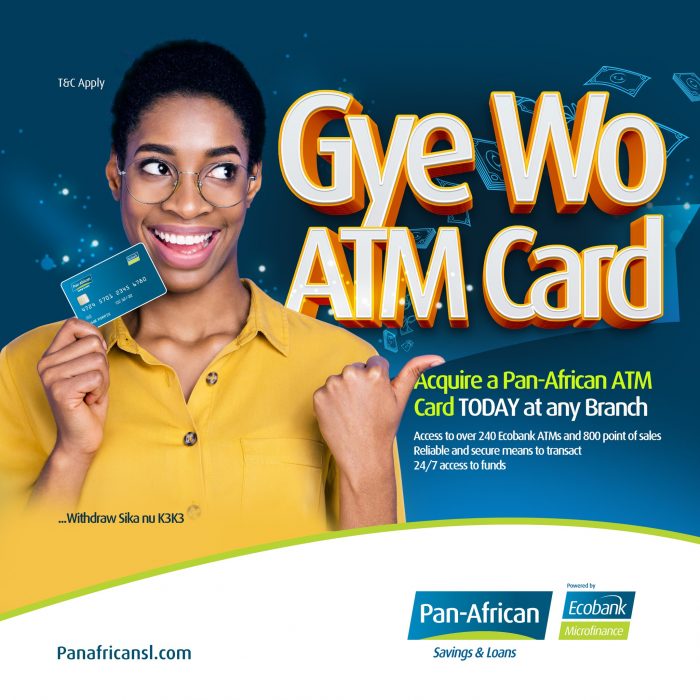

The Ecobank Pan-African Card carries the PAN logo, telling you that it’s acceptable in over 36 countries. With this amazing card lets you withdraw cash, make online purchases, and pay online when you see the PAC logo.

Ecobank Nigeria has a mobile app that you can download on your internet-enabled devices to send, receive, transfer, and make online purchases 24/7. You can even use the mobile app to transfer funds from your local bank account to a dollar-based account abroad. You can download the app on your Android and Apple devices.

Ecobank Pan-African Card Features

Online Transactions

Cardholders will enjoy payment access on ATMs, web transfers, and POS transactions. Whether you are based in Lagos, Port Harcourt, or any of the Nigerian cities, you can use the credit card to get cash at any nearby ATM point close to you.

Additionally, the Pan-African Card offers a number of rewards, including concierge services, invitations to exclusive lifestyle events, dedicated premier lounges, discounts on luxury goods or services from approved suppliers, and exclusive offers to VIP members. The card also offers priority pass airport lounges in over 600 airports globally.

Ecobank Pan-African Card is perfect for you

Seamless Travel Across The World with your Ecoban Pan-African

The Ecobank Pan-African Card is suitable for both informal and corporate spending in any part of the world. The card gives you the freedom to travel any part of the world without carrying any physical cash. If you are a business person and you have employees or suppliers that you need to pay either weekly, bi-weekly, or even monthly.

You can set up automatic transfers using this credit card to meet your financial demands. Every transaction that you carry out using this credit card is documented in your statement of account. You can always reach out to the bank for them to furnish you with your statement of account if you are in doubt of anything.

Enjoy Discounts At Major Shops with you Ecobank Pan-African

Cardholders are guaranteed discounts at major shops from across the world. The Ecobank Pan-African Card is also very important whenever you intend to purchase groceries, food, or even pay hotel bills. You will even enjoy robust security while making the purchases since you’re not moving around with any physical cash.

One of the key benefits of using this card is that you are entitled to enjoy periodic discounts from selected shops across Nigeria. You may even choose to pay off all the amount that you have expended at the end of the month when you receive your paycheck or spread the payments over a period of time so that your family finances do not suffer.

Global Acceptance

Imagine a credit card that is recognized in at least 200 countries and in over 10,000 point-of-sale (POS) terminals. That credit card is no other than the Ecobank Pan-African Card. If you travel outside of Nigeria to other countries; maybe for a vacation or for a business endeavor, you do not need to open a new account when you arrive at your country of destination .

You can use this credit card to make purchases or even withdraw cash at an ATM point. That’s not all; for those that are into online sports betting, forex, or cryptocurrency trading, the Ecobank Pan-African Card has got you covered when you need to fund your account.

Withdraw Cash At ATMs

As mentioned above, you can use the Ecobank Pan-African card to withdraw cash at an ATM terminal in any part of the world. Cash withdrawals at an ATM point come with a fee if you are withdrawing from an ATM that doesn’t belong to the bank.

Let’s say you withdraw cash at an ATM point that belongs to Standard Bank, the bank will charge you a fee to get your cash withdrawal. There are other fees like monthly maintenance charge, SMS alert charge, and account statement printing charge.

Receive SMS Alert After Each Transaction

For every transaction that you carry out using the credit card, the bank will send you an SMS alert to notify you about the transaction. This is very important so that whenever a third-person assesses your credit card to make an online transfer or transaction.

You will receive an SMS alert on your phone imediatley. For notify you of that transaction. So grace to that you can immediately reach out to the bank’s customer support representative for them to block the card.

Ecobank Nigeria Mobile App

Ecobank Nigeria has a mobile app that you can download on your smartphone to live a digital life. Do you need airtime on your phone? You want to pay utility bills? The Ecobank Pan-African Card has got you covered. You can pay bills with a single click on the app.

All you need to do is to download the bank’s mobile app on your smartphone and then link the credit card with the mobile app. You may likely receive a 6-digit verification code to ensure that you are the rightful owner of the card. Enter the 6-digit code in the space provided, and you will be on your way to activating your credit card to enable you to make online transfers or payments.

Ecobank Nigeria Customer Support

Ecobank Nigeria has a user-friendly and interactive customer support team. As you interact with the bank, if you encounter any challenges, the customer support team is on ground to walk you through any challenges.

You can reach them on 07005000000 or +2347080653700 or + 23412701323. You can also reach the customer support desk via the bank’s Premier Number: 0700PREMIER (07007736437) or Advantage Number: 0700ADVANTAGE (070023268243) or Toll Free 0700PREMIER (07007736437).

Live Chat

The bank has a live chat feature. You can use the live chat feature to speak with one of the bank’s customer support representatives online. One good thing about using the live chat feature is that the agents are online 24/7.