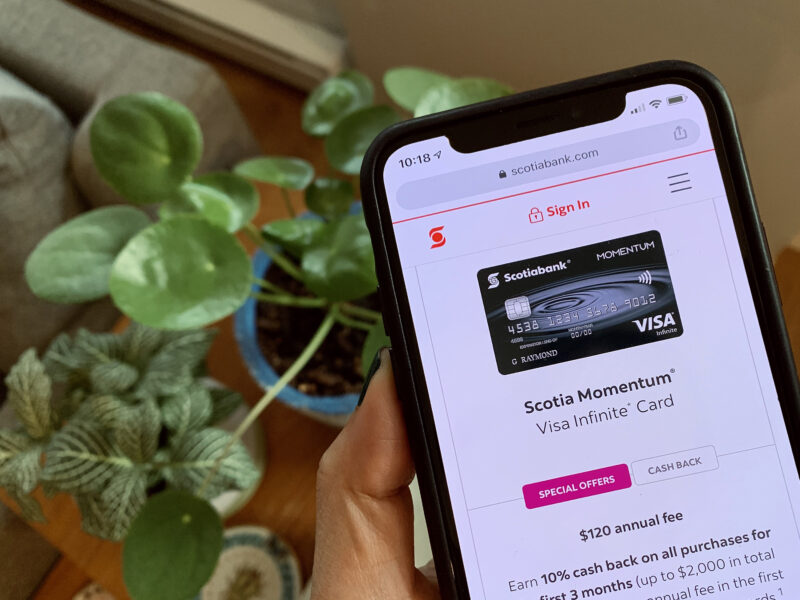

Additionally, if applying by April 30, 2023, it offers a significant welcome proposal of 10% over the first three months and a cashback of up to $2000. But does that make up for the strict redemption restrictions on this credit card? Here is all you need to know about the Scotia Momentum Visa Infinite card and how it compares to the alternatives.

Manager Olivia C.

Usually responds within 5 minutes.

Disclaimer: By clicking on the “Go To Messenger” button above, you will be redirected to the messenger website/app. In order to get assisted however, you are going to have a messenger account and you must to be logged, otherwise we won’t be able to help you. So please make sure that you have an account and you are logged on it.

Therefore, for starters, if you spent $2,000 in the initial three months (a $200 value), gain 10% back in cash. Your account must be established by April 30, 2023. obtain 4% cash back on grocery and recurring bill purchases. Earn 2% back in cash when you buy gas and travel. Gain 1% on all cash back and other purchases with no cashback cap.

Includes reveal insurance protection such as airline insurance that is delayed and lost luggage insurance, travel medical emergency insurance, as well as travel accident coverage. Includes loss/damage protection for rented vehicles. Protection for portable electronics up to $1,000. Purchase an extended warranty and security protection. Renting a car from your participating budget and Avis outlets are discounted by 25%. Visa has endless advantages, like hotel upgrades and concierge services.

What can this card do for you in terms of supermarket chains?

The Scotia Momentum Visa Infinite card is a renowned credit card that offers cash back, and performs admirably in terms of travel protection, however, has space for growth in terms of cash-refund bonuses. Given that supermarket prices have been rising, the highest cash-back level for this card is a 4% offer for cash back on supermarket purchases, it might appear to be a selling point.

Before making a choice, think about where you shop due to their preference for the network of Mastercard, the best several supermarket chains in Canada, won’t take this specific credit card or any Visa supposing that. The 4% reward offered by this credit card as well applies to paying bills and renewals.

Families that are anticipating higher expenditures due to inflation, such as unexpected heating costs, may find this feature to be quite helpful. The only little catch which was before the charge is required to be eligible for the category because manual payment of invoices is not accepted.

Fortunately, public transit and electric car charging are included in the additional cash-back category on the Scotia Momentum Visa Infinite card, which gives a 2% return on petrol and everyday travel if those expenses are typical one for you. A 1% cash refund return is given for all other purchases.

Applying by April 30, 2023, the visa Infinite Scotia Momentum card as a welcome incentive, 10% cash back will be given on all purchases for the first three months. Only the initial $2,000 in buying is eligible for the incentive offer, therefore no more than $200 may be earned. Additionally, the additional cash back is only given If your account is not in overdraft or past due seven months following the card’s activation and only then.

The strict conditions for cash-back earnings on this card are a big drawback. Cardholders only receive rewards in November of each year. Your cashback will be lost if at that time your account isn’t in good standing. The same rules apply if your minimum repayment amount is late due or you have an overdraft.

Additionally, unless you expressly request differently. Your reward will be sent to your Scotiabank checking or savings account instead of credited to the statement of your credit card. The travel insurance program is what card that excels the most in comparison to comparable cashback credit cards.

You will be covered for a missed flight or cancellation, lost or delayed baggage, travel, and delays with aircraft-related accidents. Even if the limitations are smaller than the things you receive this coverage is among the best offered in the cash-back category when using a travel rewards credit card, such as the Scotia Passport Visa Infinite card.

A handy partner

Make all of your supermarket purchases with this card, and routine bill payments to maximize the benefits of the highest cash-back category. To receive a 4% cash refund, you must enroll in automated billing with your card; Manual credit card bill payments will not qualify. Due to its superior coverage for travel insurance, this card is well useful for making travel-related purchases.

But be aware that only 1% of anything instead, the cash-back category is applicable for traveling frequently and isn’t focused on getting cash back in particular, you may choose a different credit card with travel protection so that you can also gain benefits when you make reservations. Earning benefits with the Scotia Momentum Visa Infinite card is simply because they are computed and paid immediately.

Every time you make a purchase, the transaction shows the category and value of the cashback. Your monthly invoice will show the total amount of cash refund you have earned. Your cashback points will be transferred into your Scotiabank checking or savings account if you have one. The cash refund incentive will be immediately charged to your credit card bill if you don’t have a checking or savings account with Scotiabank.

Finals

For your most important expenditures, choose the Visa Infinite Scotia Momentum card. Mastercard with BMO Cashback World Elite is particularly strong competition for the premium card of Visa Infinite by Scotia Momentum. Cashback on every buy, as well as 1% on every other subject and 4% for shopping and regular expenses such as invoices and subscriptions. Petrol and everyday transportation expenses are covered by 2% cash back. Get a welcome offer that comprises 10% cash back on every buy and excellent insurance coverage.